- News

- Technology News

- Tech News

- Elon Musk says "social security is the biggest Ponzi scam off all time"; know why he thinks so

Trending

Elon Musk says "social security is the biggest Ponzi scam off all time"; know why he thinks so

Elon Musk criticized the US Social Security system, calling it 'the biggest Ponzi scheme' due to its pay-as-you-go structure and increasing financial strain from demographic shifts. He argued that the system's long-term obligations amplify national debt. His remarks sparked debate, with some supporting the need for reform and others defending the program's historical success.

Elon Musk, the billionaire entrepreneur and CEO of Tesla and SpaceX, has once again made headlines with his controversial remarks. During his recent appearance on The Joe Rogan Experience podcast, Musk referred to the United States' Social Security system as "the biggest Ponzi scheme of all time." His statement quickly went viral, sparking widespread debate among economists, policymakers, and the public. Musk justified his claim by highlighting the financial burden of the program, pointing out that increasing life expectancy and declining birth rates could make future obligations unsustainable. His remarks come at a time when concerns about the long-term viability of Social Security are already a pressing issue in American politics.

Elon Musk’s controversial statement on why US social security is a Ponzi scam

During his conversation with Joe Rogan, Musk explained why he views the Social Security system as unsustainable. He argued that the program operates on a pay-as-you-go basis, where current workers fund the benefits of retirees, rather than individuals saving for their own future. "People pay into Social Security, and the money goes out of Social Security immediately," Musk said. He added that the total obligations of the program exceed its tax revenue, making it financially unsound in the long run.

Musk further elaborated that demographic shifts—such as increasing life expectancy and declining birth rates—worsen the financial strain on the system. "Basically, people are living way longer than expected, and there are fewer babies being born, so you have more people who are retired and that live for a long time and get retirement payments," he explained. According to him, this imbalance will only exacerbate the financial challenges facing Social Security in the future.

Elon Musk says US debt ‘far worse’ due to social security

When Joe Rogan pressed him for further clarification, Musk brought up the concept of national debt, arguing that Social Security obligations are often underestimated. "There's our present-day debt, but then there's our future obligations," Musk said. He claimed that the real national debt should include long-term Social Security liabilities, which would make the fiscal situation look significantly worse than it appears.

Musk’s argument aligns with concerns raised by economists who warn that Social Security's unfunded liabilities—estimated to be in the tens of trillions of dollars over the coming decades—pose a major financial challenge for the U.S. government. However, others argue that Social Security can remain viable with policy adjustments, such as raising the payroll tax cap or adjusting the retirement age.

Reactions to Musk’s statement

Musk's remarks quickly became a trending topic, drawing mixed reactions from various quarters. Critics accused him of oversimplifying a complex issue and fearmongering, while supporters praised him for bringing attention to a topic that many politicians avoid discussing.

Some financial experts pointed out that while Social Security faces long-term challenges, calling it a Ponzi scheme is misleading. Unlike Ponzi schemes, Social Security is a government-mandated program that has been in operation for decades, providing financial security to millions of retirees. However, others acknowledged that demographic trends could create funding shortfalls if reforms are not enacted.

On the political front, conservative lawmakers and fiscal hawks echoed Musk’s concerns, arguing for urgent reforms to prevent Social Security from becoming insolvent. Meanwhile, progressive politicians and advocacy groups dismissed Musk’s characterization, emphasizing that the program remains one of the most successful social safety nets in U.S. history.

Future of social security: Reform or crisis

The future of Social Security has been a subject of debate for years, with experts offering different solutions to address its financial sustainability. Some proposed measures include:

- Increasing payroll taxes: Raising the cap on taxable income could generate additional revenue for the system.

- Raising the retirement age: Adjusting the retirement age to reflect longer life expectancies could help balance payouts.

- Means testing benefits: Reducing or eliminating benefits for high-income retirees could ease the financial burden.

- Privatization or partial privatization: Some advocate for allowing individuals to invest a portion of their Social Security contributions in private accounts.

Despite these potential solutions, social security remains a politically sensitive issue, making major reforms challenging to implement.

Also read | Genshin Impact Codes | Fruit Battlegrounds Codes

End of Article

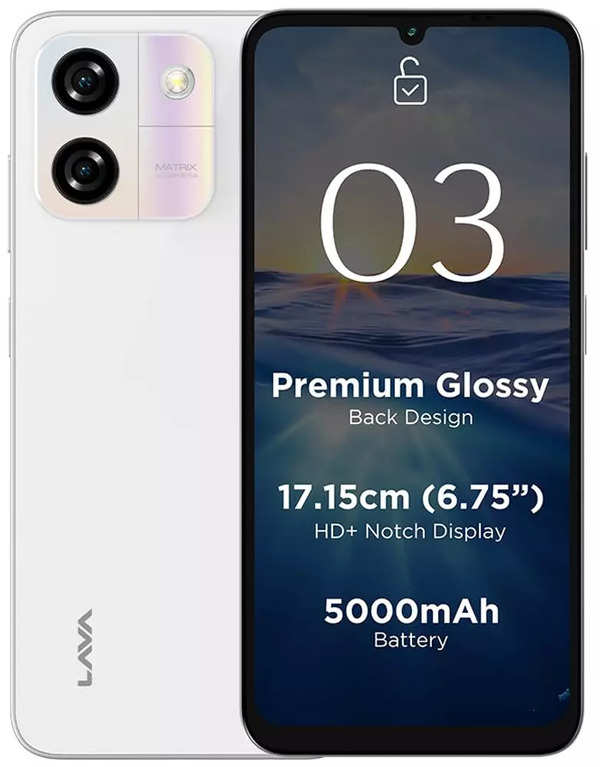

Latest Mobiles

FOLLOW US ON SOCIAL MEDIA